Credit scores are one small part of life, but they don’t always feel that way. When you have a low score, it can feel like there are big barriers all around, holding you back and stopping you from accessing the things you want or need. This can be frustrating – particularly when you are confident that you’ll be able to afford the repayments.

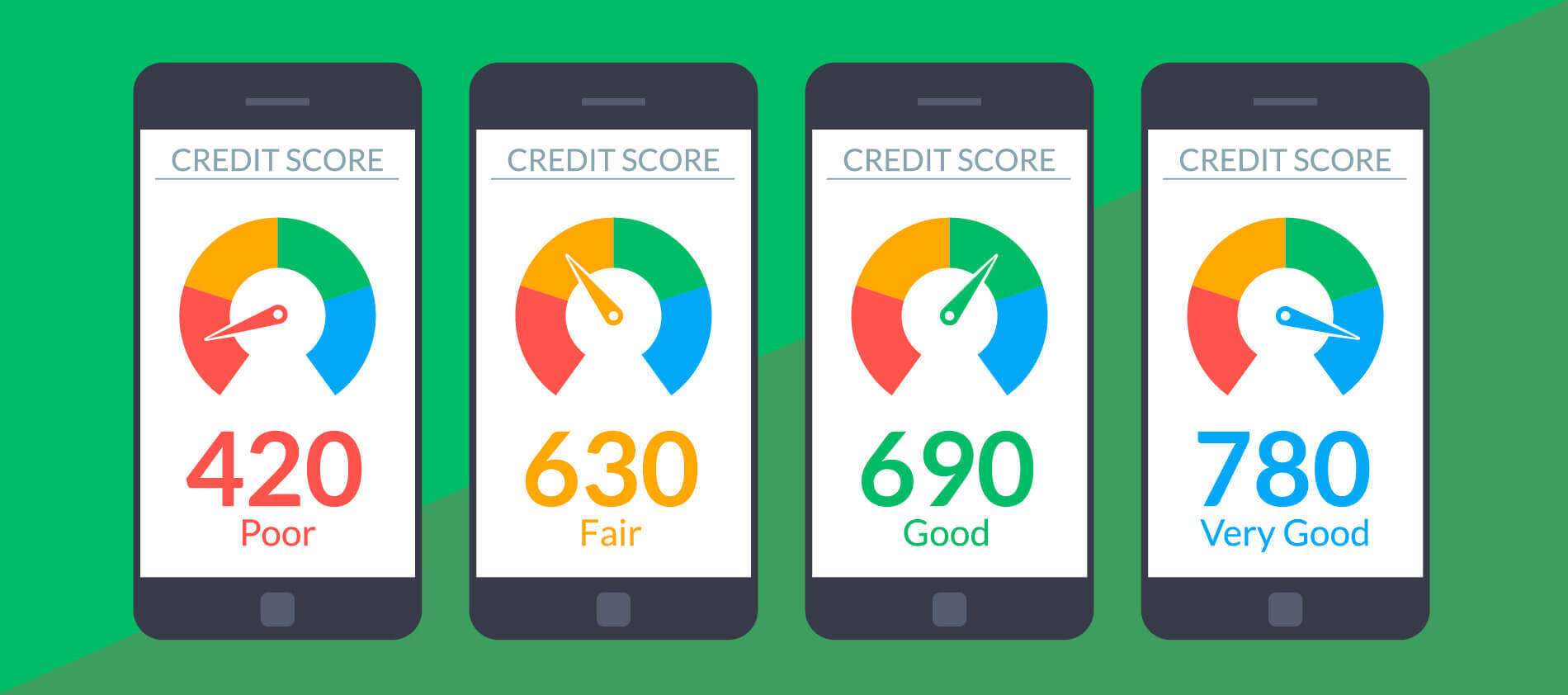

Confusingly, each credit reference agency uses a slightly different scale and scoring system to present your credit score. However, one thing remains the same; the higher the number you are given, the better your credit. Rebuilding your score and getting that number up is a process that takes time and commitment – but it can be done.

To make steps towards improving your credit score, it’s important to first understand what kind of information companies and credit agencies take into account when calculating your number. Each of the following points has an impact on your credit score: